Technical Analysis of a Markets Expert: An Interview with Jim Wyckoff

It is always great to come across individuals whose long-term mission is to help traders become more successful. I recently spoke with veteran market analyst, Jim Wyckoff, who has spent the better part of two decades involved with the stock and commodity futures markets as a financial journalist and technical analyst. In this interview, we catch a glimpse into the evolution of Jim’s career, the daily mechanisms he uses to draw forth market insight, his advice to new traders, and his perspective on the one commodity that is “hot to trot” right now.

Jim Wyckoff

G39: When did you first become interested in futures?

JW: I studied journalism and economics in college and was hired as a floor reporter at the Chicago Mercantile Exchange in 1985. Working on the trading floors in Chicago, New York and around the world was the greatest learning experience for getting educated on markets and trading–and one that very few get to experience.

G39: What does the start of your day look like?

JW: I get up at 5:00 a.m. Chicago time and am at my desk before 5:30 a.m. I’m fortunate to be able to work from home for the past 18 years. I scan the overnight news and then my reporting/analysis day begins. My early mornings are the busiest — putting out reports and producing analytical charts — but it’s nice to get that out of the way because the rest of the working day is downhill on deadlines.

G39: You put out a ton of great market insight — do you find time to trade for yourself?

JW: I don’t trade much anymore. I do still like to trade, but my daily deadlines for markets research, stories and such keep me fully occupied.

G39: Has the recent political climate affected one commodity or sector much more than the others?

JW: Yes. Gold has popped on the geopolitical tensions. Other raw commodity markets have also benefitted on ideas that better world economic growth will improve demand for those commodities.

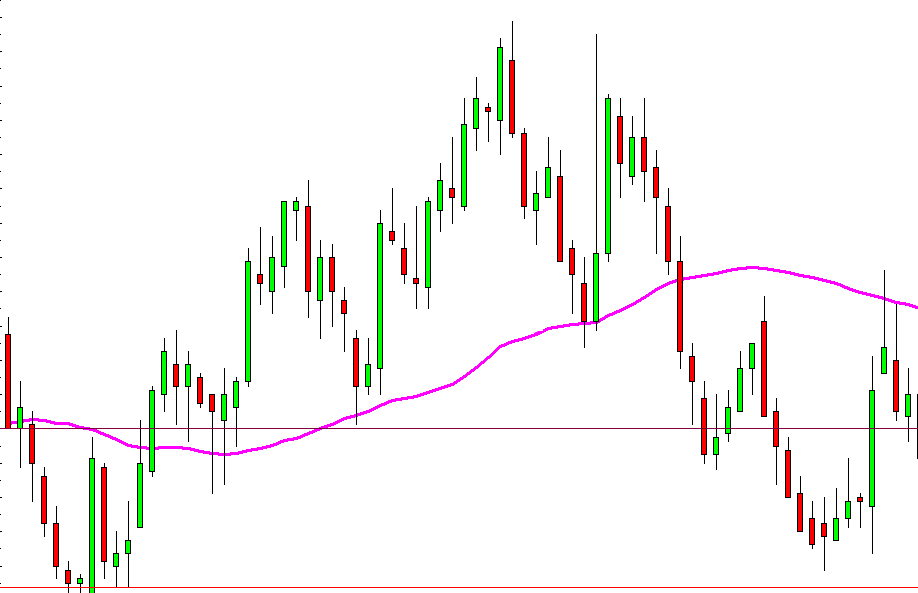

G39: People tend to be visual creatures. Visual charts convey information to a trader much quicker than a pure set of numbers, right? Do most traders rely on both visual charts and numerical data?

JW: Very good point, Sarah. We all know that in this day and age, people want information quickly and in concise segments. They don’t have time to consume some long story or crunch a bunch of numbers. My analytical charts provide a picture and a very short story, right on the chart, on that particular market. It’s quick and easy. Remember the old adage, “a picture is worth 1,000 words.”

G39: How has your charting evolved? Do you have a favorite analysis / charting program?

JW: I started my career plotting bar charts manually. There were virtually no computer charting programs for the general investing or trading public in the early 1980s. We all got our charts in the mail at the first of the week and then updated them by pencil in hand until the charts came the next week.

So, I still base most of my analysis on price trend. Most successful traders and analysts also base their work and trading on price trend. I suppose my favorite computer-generated technical studies would be the Relative Strength Index, moving averages and the Moving Average Convergence Divergence (MACD) indicator.

G39: For new futures traders just starting out, what is one essential skill you would recommend honing in “reading the markets”?

JW: Be able to recognize the price trend in the time frame in which you are trading. Also, know how to determine technical support and resistance levels in your trading timeframe–they make great entry and exit points.

G39: In your opinion, what has been the most interesting commodity to follow this year? Why?

JW: Gold. This market gets “left for dead” more often than any other market–only to rise again during times of heightened geopolitical uncertainty.

G39: What’s one of the biggest mistake you see traders making these days?

JW: It’s the same as in previous years and decades: Improper money management. Traders need to know when to throw in the towel on their losing trades. It’s an aged market adage, but it’s tried and true: CUT YOUR LOSSES SHORT AND LET YOUR WINNERS RUN. That statement sounds easy to employ but it’s difficult to follow during the heat of trading battle.

G39: Thanks for providing a glimpse into how your expertise has evolved and how you operate in serving traders on a daily basis. You’re known in the industry as a very prolific purveyor of market intelligence, so if someone were interested in seeking out your analytical, educational and trading advisory services, where can they find you?

JW: They can check out my website at www.jimwyckoff.com, ring me at 319-277-8643, or email me at jim@jimwyckoff.com.

Editor’s Picks

Summer is here, and that means it’s BBQ season — a time for hot-off-the-grill favorites, refreshing sides, and sweet treats to finish it all off. But...

Connect with us to discover how we can help your business grow.

.jpg)

![What’s on Your Marketing Plate This BBQ Season? [Take the Quiz!]](https://www.gate39media.com/hubfs/Marketing%20BBQ.jpg)