Automating marketing and customer support can be crucial in reducing costs, reducing customer service lead times, and scaling your company. According to Juniper Research forecasts, chatbots will allow banks to save billions of dollars in the next decade. By 2022 chatbot use will be responsible for 8 billion dollars in annual cost savings. These are numbers too big to ignore. But marketing automation presents a special set of challenges.

Additionally, marketing automation, artificial intelligence (AI) and the use of robo-advisors continues to climb. Robo-advisors provide clients with financial advice based on math rules or algorithms, the likes of which are not only designed for less error and emotion — but reduced human intervention.

However, most people still want a “human” experience, especially in the financial services industry where personalized service, relationships built on trust, and meaningful interactions with attentive and knowledgeable professionals are so important. Every interaction must assure clients that their money is in the right place.

So how can financial firms reap the benefits of chatbots, marketing automation, and robo-advisors without losing their personal touch? Let’s look at 10 ways.

1. Seamless Human Takeover

The best chatbots know exactly when to transfer a conversation to a human. Bots are great for simple interactions but in cases where complex operations are involved human intervention may be necessary. On that note, there is nothing more frustrating than a bot failing to fulfill a client’s need for human assistance.

Redirection from a bot to an operator must be effortless. For instance, bots should have a “switch to human” trigger which can be activated if your client types in keywords in the nature of ”human”, “operator” or “talk to someone” or if your bot fails to understand your client’s intention repeatedly. In these circumstances, your bot should ask them “Do you wish to chat with a representative?” and your trustworthy operators should be on call and ready to take over.

2. Understand Intent

Even though your client may not be 100% clear or overt in their chat communication a smart bot should be able to understand their intent. A financial chatbot should be able to understand what a client means when he or she types in a question such as “how much money do I have” instead of just understanding specific queries such as “what is my account balance”.

Even though your client may not be 100% clear or overt in their chat communication a smart bot should be able to understand their intent. A financial chatbot should be able to understand what a client means when he or she types in a question such as “how much money do I have” instead of just understanding specific queries such as “what is my account balance”.

Wells Fargo´s chatbot is very proficient in understanding user intent. Notice how the bot understands “how much do I have”.

Bank of America ́s bot Erica — with 6+ million users –is another great example. Users rave about Erica ́s transaction-search capability and understanding of speech nuances. She not only helps with client transactions but serves as an advanced virtual assistant to help clients make smarter decisions.

3. Analyze Automated Interactions

Chatbot performance should constantly be analyzed for improvements to humanize interactions. We assume how users will interact with our bots based on past interactions with operators and common social conventions. However, nothing is more accurate than actually reading the interactions. What are the most typical questions? Are they answered properly? Does the flow make sense?

Analyzing conversations allows financial firms to assess if clients are satisfied with the automated experience. If a particular answer or feature is annoying or confusing it must be updated or replaced. Another way of learning if clients are satisfied is by gathering feedback from a chatbot after an interaction concludes.

4. Keep the Conversation Natural

Unfortunately, bots lack many of the traits that make us human. So, for conversations to seem more natural and human-like, firms must program emotions and “warmth” into bot responses.

Financial Marketing: Building a Conversational Growth Strategy Within S.C.O.P.E.

A bot should use the language of a friendly human in addressing a client by her name, using emojis, and simple casual words that any friend would use. Interactive nuances like these can go a long way in adding a human touch to the interactions. A successful bot will respond in such a natural way that users should have doubts about its synthetic nature: “Is she really a bot? It sounds like a human to me!”

5. Give a Bot an Identity

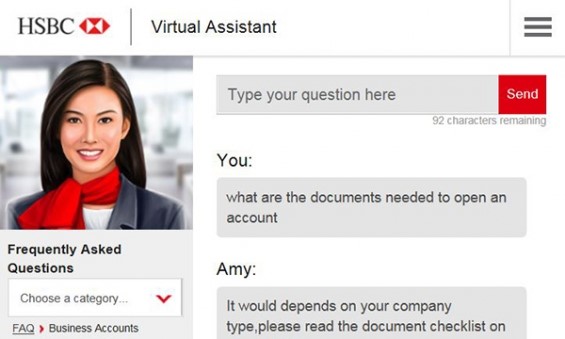

Example: Amy from HSBC

Chatbot rule # 1: never pretend your bot is human. Your clients will know the difference, no matter how advanced your bot is. However, giving your bot a human identity can make the interactions more enjoyable. Famous bots such as Alexa, Cortana, and Siri all have a very distinct personality. Amazon’s Alexa is even classified as a ESFJ according to the Myers-Briggs type indicator. Those initials stand for extroversion, sensing, feeling, and judging.

You can model your bot after one of your own customer service agents. What personality traits do clients love about him? Have your IT team add those to your bot. Once you create a personality for your bot, its language, phrasing, humor, and communication style should all adhere to the bot ́s personality. Your clients might even remember the name of your bot and he can achieve fame of his own!

6. Typing Indicators

A rather simple feature that can have a big impact on making your bot seem more human. We are not used to immediate responses, regardless if we are dealing with bots or humans. We are used to waiting, at least a bit, for a response. The 3-dot typing indicators are a nice way to communicate that an answer is coming, we just have to wait a few seconds for it. A bonus of using typing indicators is that they create the impression the bot is “thinking”.

A rather simple feature that can have a big impact on making your bot seem more human. We are not used to immediate responses, regardless if we are dealing with bots or humans. We are used to waiting, at least a bit, for a response. The 3-dot typing indicators are a nice way to communicate that an answer is coming, we just have to wait a few seconds for it. A bonus of using typing indicators is that they create the impression the bot is “thinking”.

7. Take the Conversation to a Familiar Environment

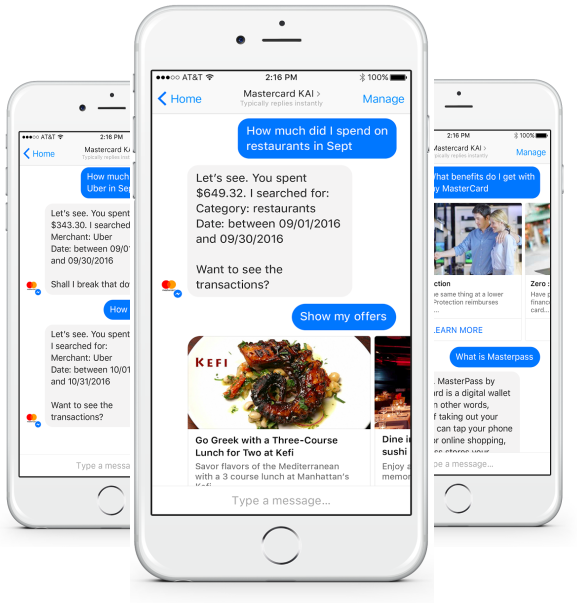

Commonly used interfaces such as the Facebook Messenger App can make your clients feel more at home. They are already familiar with the usability, emojis, and notifications of the interface and they associate it with conversations with friends and family. You can experiment giving users the option to switch to the Facebook Messenger App from your website or let them know they can chat with a bot directly from your Facebook page. These messaging platforms also allow your firm to actively message users. Beware though, too many unsolicited messages can be annoying.

Example: Mastercard bot on Facebook Messenger

8. Segment Your Email List

According to Campaign Monitor, email marketing has the highest ROI of any marketing channel — 4400% ROI and $44 for every $1 spent. Yes, email automation can be very profitable for you and helpful to your clients. As long as it’s relevant — nothing compromises your email efforts more than sending irrelevant information to your lists.

Don’t Think You Need Email Marketing? These Stats Show Why You Should

Fortunately, automated email marketing through software such as HubSpot, allows firms to easily segment recipients. They can be segmented by the type of product they are interested in, age, income bracket, profession, and other characteristics. Once you segment your recipients, you can send them content relevant to their particular situation. This way you avoid sending mortgage deals to retirees and estate planning advice to college students. You can qualify your prospects in the email opt-in form.

9. The Person Behind Your Automated Emails

You can make your email experience more human by adding an employee’s signature, name, and email address instead of a business name as the sender. This way your customers feel they are getting an email from a fellow human rather than a lifeless company. Having a real person behind your emails makes them more personal and more likely your clients will respond. Recipients can respond to your emails, right?

If you do not have a “reply to” address, you definitely should. Look at it from your clients’ perspective. What is the point of receiving an interesting email if replying is not possible? To make your automated email experience more human, all your email replies should be received by someone capable of offering a prompt and complete response.

10. A Hybrid Solution: Robo-Advisors and Humans

Robo-advisors can use all of the previously mentioned resources to offer a more personalized service. However, there is one aspect of robo-advisors that can have a major positive impact on your clients. A hybrid robo-advisor / human experience.

Your firm can start off with financial planning basics using a robo-advisor and if a client needs specific advice or suggestions he can receive human support. The experience should be customizable; by collecting customer data you can understand what types of clients will most likely need the support of a human. Most likely beginners who are not quite comfortable with robo-advisors or investors who want to step into a more advanced investment strategy.

You can transition from robo-advisor to human if a client mentions that they cannot continue with a transaction if they do not talk to a human advisor first.

While technology in financial services is innovating in a direction of increasing AI, bot usage and marketing automation, following these 10 tips can help create the necessary and authentic “human” experience essential to communicating with, servicing, and providing value to actual human clients.

—

Interested to know more about humanizing your marketing automation processes? Contact us.

You may also be interested in: